If you’re looking to access your Milestone Credit Card account, simply visit milestonegoldcard.com and log in to manage your card and finances effortlessly.

MyMilestoneCard, offered by the Bank of Missouri and Genesis Financial Solutions, is a unique credit card designed for ease and financial growth. Ideal for those with moderate credit, it helps build credit scores and offers exclusive benefits, accessible through a user friendly online platform, making financial management both straightforward and rewarding.

What is Milestone Credit Card?

The Milestone Credit Card is a financial tool designed to help people establish or rebuild their credit. This card is especially useful for persons who have had financial setbacks or are just starting to develop credit. Because it is a MasterCard, it is widely accepted worldwide.

| Name | Milestone Credit Card |

|---|---|

| Credit Limit | $700 |

| APR | 35.9% |

| Grace Period | 25 Days |

| Monthly Fee | $14.50 (First Year). After that, $19.25 |

| Foreign Transaction Fee | 1% |

| Cash Advance Fee | $5 or 5% whichever is greater (not to exceed $100) |

| Late Payment Fee | Up to $41 |

| Overlimit Fee | Up to $41 |

| Returned Payment Fee | Up to $41 |

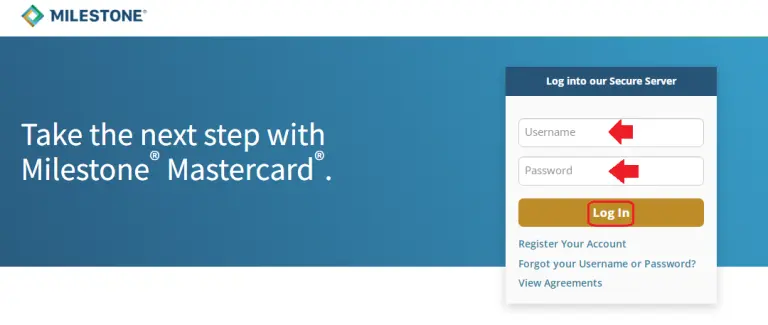

Milestonecard.com/activate Login

– Step By Step Process

Step 1: Go to Official Site:

- Visit the Milestone Credit Card official website.

Step 2: Locate Login Section:

- Find and click on the “Login” or “Account Access” area.

Step 3: Enter Credentials:

- Enter your username and password.

Step 4: Click ‘Login’:

- Press the login button to access your account.

If You Are Having Trouble Logging In, “Change Username or Password”

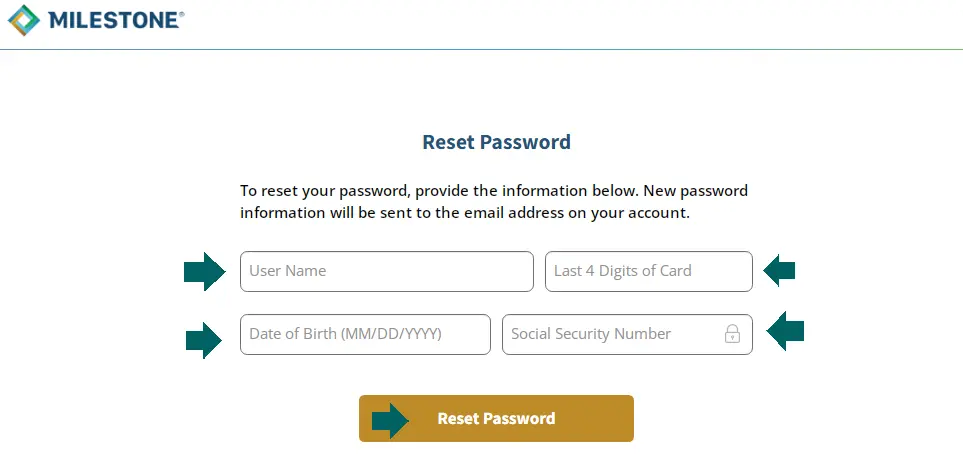

(A): To Reset Your Password

To reset your password for the Milestone Credit Card, follow these simple steps:

Step 1: Visit Website:

- Go to the Milestone Credit Card’s official website.

Step 2: Click on ‘Forgot Password’:

- Click on the ‘Forgot Password’ link on the login page.

Step 3: Enter Information:

- Enter your account information, such as your username, last 4 digit card, date of birth & social security number.

Step 4: Click ‘Reset Password’

- After entering all the information click on Reset Password button.

Step 5: Verify Identity:

- Follow the prompts to verify your identity. This might involve answering security questions or confirming details via email or text.

Step 6: Set New Password:

- Once verified, you’ll be given the option to create a new password.

Step 7: Confirm Changes:

- Submit the new password and confirm the change.

Use your new password to log into your account.

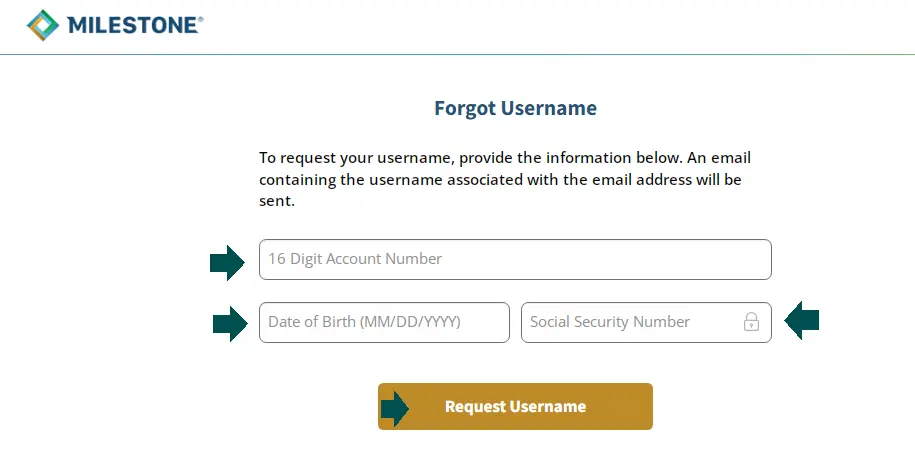

(B): To Request Your Username

To request your username for the Milestone Credit Card, follow these steps:

Step 1: Visit the Website:

- Navigate to the Milestone Credit Card official website.

Step 2: Find ‘Forgot Username’:

- Click on the ‘Forgot Username’ link, usually on the login page.

Step 3: Enter Required Details:

- Input necessary information, such as your 16 digit account number, date of birth & social security number.

Step 4: Click ‘Request Username’:

After entering all the information click on Request Username button.

Step 5: Complete Verification:

- Follow any additional steps to verify your identity.

Step 6: Retrieve Username:

- After verification, your username will be provided or sent to your email.

Use the retrieved new username to log into your account.

Milestone Card.com/activate Login

Go to Website:

- Visit 👉 www.milestonecard.com/activate

Click on “Activate Your Card”

- You’ll see an option to activate your new card.

Enter Details:

- Fill in your card number, date of birth, and SSN last 4 digits.

Login or Create Account:

- If you already have an account, log in.

- If not, click “Register Your Account” to create one.

Follow Instructions:

- Complete the steps shown to activate your card.

Done!

- Your Milestone Card is now ready to use.

Benefits and features of the Milestonecard Com Activate Login

The key benefits and features of the Milestone Credit Card include:

- Credit Building: Ideal for those looking to establish or improve their credit score.

- Accessible Approval: Welcomes a wide range of credit scores, including less-than-perfect credit.

- Customizable Credit Limit: Offers adjustable credit limits to suit individual financial needs.

- Simple Online Application: Easy and quick application process, done entirely online.

- Regular Credit Reporting: Reports to all three major credit bureaus.

- No Security Deposit: Unsecured credit card, no deposit required.

- Fraud Protection: Comes with robust security features for transaction safety.

- Online Account Management: Easy monitoring and management of the account online.

- Credit Limit Increases: Potential for increased limits with responsible usage.

- Free FICO Score Access: Allows tracking of credit score progress.

- Global Acceptance: Widely accepted as it’s a MasterCard.

- Competitive Annual Fee: Reasonable fee structure compared to similar cards.

Features of the Milestone Credit Card Activate

| Feature | Details |

|---|---|

| Credit Limit | $300-$750, based on creditworthiness |

| Annual Fee | $35-$99, depending on credit history |

| APR | 24.90%-26.90% for purchases and cash advances |

| Fraud Protection | Included for secure purchases |

| Credit Bureau Reporting | Genesis FS Card Services reports to major bureaus |

Key Features of Your Activate Milestone Credit Card

- No security deposit required

- Reports to all three major credit bureaus

- 24/7 online account access

- Fraud protection

- Paperless statements

Eligibility Criteria To Apply For The Milestone Credit Card

- Age and Residency: Applicants must be at least 18 years old and residents of the United States.

- Application Process: Involves filling out an online form with personal and financial details.

- Must Have: This card applicant must have a permanent address, a bank account, a US ID, and a ‘SSN‘ social security number.

- Response Time: Quick response to applications, with the card being sent out within a few days of approval.

- Other Instructions: Must follow all the guidelines and official norms and instructions

Activate Milestone Card

By Online

- Visit the Website: Go to the Milestone Credit Card activation page.

- Enter Card Details: Provide your card number and other requested details.

- Verify and Submit: Follow the prompts to verify your identity and submit for activation.

By Phone

- Call the Number: Dial the activation phone number (800) 305-0330 to activate your Milestone Credit Card over the phone. Then input your Social Security Number and follow the automated prompts to speak with a representative.

- Provide Information: Give your card number and any other required personal information.

By Mail

- Find Activation Mail: Locate the activation instructions in the mail that came with your card.

- Fill Out Form: Complete any required form or section in the mailer.

- Send it Back: Post the mail back to the provided address and wait for activation confirmation.

How to Pay Your Milestone Credit Card Bill?

To pay your Milestone Credit Card bill, you can use the following methods:

- Online: Log in to your account on the Milestone Credit Card website and follow the prompts to make a payment.

- By Phone: Call the customer service number (+2018003050330) on the back of your card and follow the instructions to pay over the phone.

- By Mail: Send a (Concora Credit PO Box 84059 Columbus, GA 31908-4059)check or money order along with your account details to the payment mailing address provided by Milestone.

Milestone Credit Card Payment and Login

First Login and Than Payment:-

- Go to the Concora Credit login page.

- Click Log-In and enter your User ID and Password.

- If you’re new, click Register and provide:

- Your 16-digit card number

- Date of birth

- Last 4 of your SSN

- Create your User ID and Password.

- Click Log‑In to access your account.

Payment Steps

- After logging in, click Make a Payment.

- Choose:

- Payment amount

- Payment date

- Payment method (bank or card).

- Submit the payment.

- (Optional) Set up AutoPay for future payments.

WWW Milestone Card Activate Pros & Cons

| Pros | Cons |

|---|---|

| Credit Building | Annual Fee |

| No Security Deposit | High APR |

| Regular Reporting to Credit Bureaus | Limited Rewards Program |

| Accessible to Various Credit Scores | Lower Starting Credit Limits |

| Fraud Protection | Fewer Perks and Benefits |

Milestone Credit Card Customer Service

- Customer Service: 1-800-305-0330

- Fax: 503-268-4711

- Technical Support: 1-800-705-5144

- Correspondence address: Concora Credit PO Box 4477 Beaverton, OR 97076-4477

📞 Need Assistance?

If you have any concerns or inquiries, Milestone’s customer care is here to help:

- Phone: 1-800-224-4960

- Mail: Concora Credit, PO Box 4477, Beaverton, OR 97076-4477

How do I activate my Milestone card?

Ans: You can activate your Milestone Credit Card online at milestonecard.com/activate by logging in (or registering) and following the activation prompts, or by calling 1‑800‑305‑0330 and entering your SSN and card info via the phone.

What is the Milestone $1,000 credit limit?

Ans: Although some sources mention a $1,000 starting limit, most Milestone® Mastercard® cards actually come with a $700 initial credit limit, with some users reporting slightly higher limits depending on their creditworthiness.

Does the Milestone card have an app?

Ans: There is no dedicated Milestone Credit Card app; however, you can manage your account online via the Bank of Missouri’s website or mobile app.

Can you activate cards online?

Ans: Yes — the Milestone card can absolutely be activated online through milestonecard.com/activate after logging into or creating your account

FAQs

Q1. How do I log in to my Milestone Credit Card account?

Ans: Visit milestone.myfinanceservice.com and enter your username and password to log in.

Q2. What should I do if I forget my Milestone login password?

Ans: Click “Forgot Password” on the login page to reset it using your account details.

Q3. Can I access my Milestone Credit Card account on mobile?

Ans: Yes, the website is mobile-friendly and can be accessed via any browser on your phone.

Q4. How do I register for a Milestone Credit Card online account?

Ans: Go to the registration page and provide your card number, date of birth, and SSN to sign up.

Q5. Is the Milestone Credit Card login portal secure?

Ans: Yes, it uses encryption to protect your personal and financial information.